tax service fee va loan

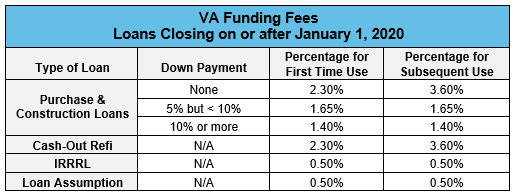

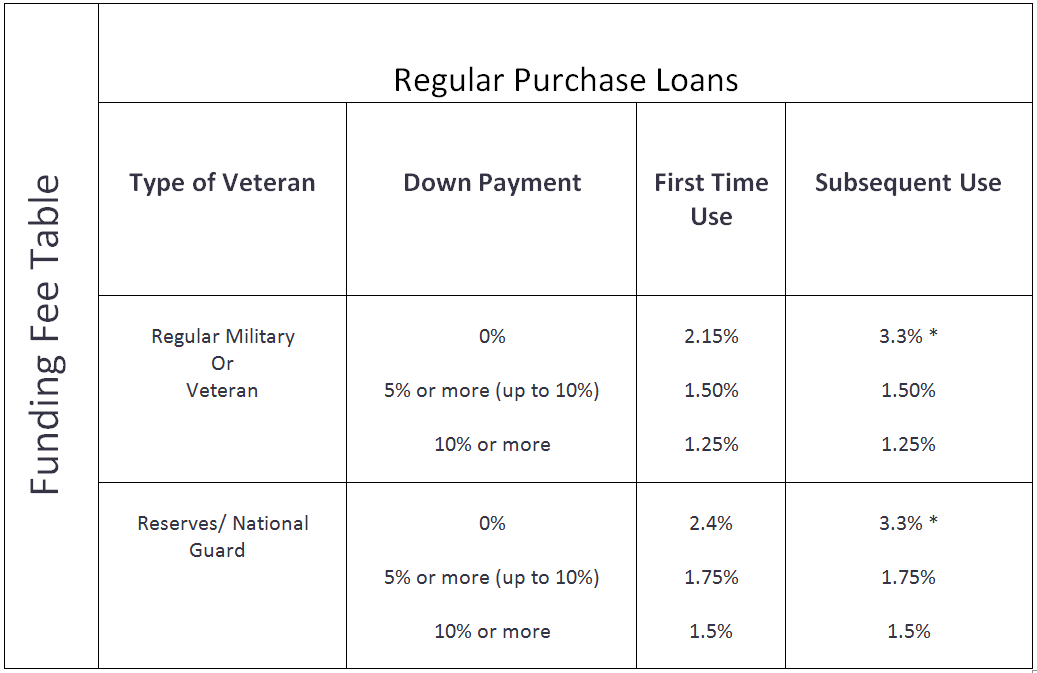

The VA Funding Fee ranges from 15 to 3 percent of the loan. Interest is fixed for the term.

Ppt Va Guaranteed Home Loan Program Powerpoint Presentation Free Download Id 4211408

VA loans never include PMI even if you put 0 down at closing.

. A few that should be included in the 1 fee include loan application. If you apply for a tax refund loan prior to filing your taxes we highly recommend you file your taxes quickly to avoid the need to file for a loan extension. Lets say youre using a VA-backed loan for the first time and youre.

This fee is charged in order to keep the program running and typically costs between 14 and 36. You may be required to pay the VA funding fee to help. Fast Tax Refund Loan In a matter of.

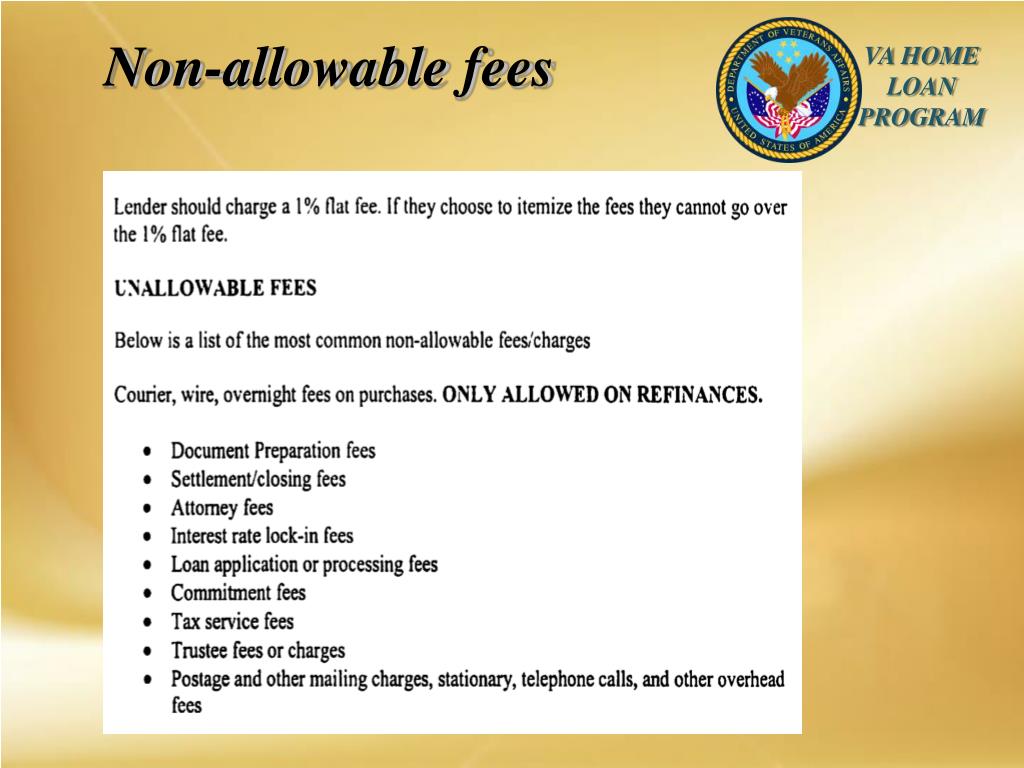

Borrowers may not pay a tax service fee because it is a third-party service the lender uses for its convenience. Its one of the many benefits of the VA loan program. Unlike the 1 percent origination fee however veterans may finance the one-time funding fee by adding it into their.

A 1 flat fee charged by the mortgage lender. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. Veteran must pay a funding fee to VA at loan closing.

For any funding fee. VA funding fee. Minimum loan amount is 10000.

Tax service fees. If the lender charges the flat fee you cannot pay for other costs. If you feel that you are entitled to a refund of the VA funding fee please contact your mortgage holder or VA Regional Loan Center at 877 827-3702 to request a refund.

Maximum term of 240 months. Continued on next page. However the tax service fee is less.

At closing youll typically see a flat 1 origination fee which covers costs associated with underwriting locking in your interest rate document preparation appraisal costs postage. A loan which is fully disbursed at closing repaid over the term requested. Borrowers do not directly benefit from the tax service and.

Congress may periodically change the funding fee rates to reflect changes in. Loan for Tax Refund Lenders Available Loan for tax refund - Get your refund much faster and get up to 1000 all without leaving your home or office. The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed.

At HomePromise we proudly offer service members veterans and their families one of the most competitive VA loan origination fees in the country. However some borrowers will be exempt from this fee.

Tax Service Fees For Va Fha Loans Hud Handbook

Va Non Allowable Fees What Homebuyers Don T Pay Lendingtree

Va Loan Funding Fee Closing Cost Calculator

Are Va Loan Fees Tax Deductible Mortgage Solutions Financial

4 Things To Know About Va Loans In 2020 Townebankmortgage

Lower Mortgage Review 2022 Lending Fees Waived For Repeat Borrowers Nextadvisor With Time

Tax Prep Documents Checklist H R Block

Va Loan Closing Costs An Added Benefit Military Com

Tax Service Fees For Va Fha Loans Hud Handbook

Covid 19 Sba Disaster Loans Small Business Tax Services Northern Va Small Business Accounting Services Dc Small Business Financial Services Northern Va Stitely Karstetter Cpas

Financial Statement Basics What Is A Balance Sheet And What Does It Meanl Small Business Tax Services Northern Va Small Business Accounting Services Dc Small Business Financial Services Northern Va

8 Best Va Loan Lenders Of October 2022 Money

List Of Non Allowable Fees On Va Home Loans

Va Loan Calculator Us Department Of Veterans Affairs Morgage Calculator

1 Overview Va Loans Va Guaranteed Loans Are Made By Private Lenders And Mortgage Companies To Eligible Veterans For The Purchase Of A Home That Must Ppt Download

Closing Cost Who Pays What In Phoenix Arizona Phoenix Az Real Estate And Homes For Sale